Being self-employed means complete responsibility for every aspect of your business, finances included. But this raises a common question: do I need an accountant or not?

In the second quarter of 2022, there were 4.29 million people self-employed in the UK. Although this is the most recent set of statistics relating to self-employment, there is expected to be a steady increase in the number of people starting and managing their own business. You may be in the process of joining them, taking the bold step to turn your dream of running your own business into a reality.

It comes with many responsibilities, including financial responsibility. Not only do you need to make money to pay yourself, as you expand and employee staff, you will also need to ensure that you pay them correctly and on time.

And then there is tax to calculate and pay, along with pensions and National Insurance obligations.

For many self-employed people, they turn to an accountant for help with their finances. But many of these independent people ultimately ask themselves the same question: do I need an accountant? Well, let’s find out.

Why is accounting important?

For many large businesses, having an accountant is vital to the smooth ongoing of the company. Accounting is the process of documenting and assessing financial activity. From these figures, an accountant and financial experts can make financial forecasts for the company such as profit warnings and tax liabilities. Even if you’re running a small business and don’t think you need an accountant, it’s vital to know why many businesses put their trust in accountants.

Having an accountant complete accurate financial recording and understanding are critical to the success of a company and this is why:

- Accurately track income and expenditure

- Help understand how money is being spent

- Measure profit and loss

- Ensure that businesses meet tax liabilities

- Help maintain an accurate payroll

- Keep the balance sheets in order

Do I need an accountant if I am self-employed?

No, it’s not mandatory for you to have an accountant when you are self-employed. You can complete your own tax returns and so on.

For sole traders, if their business is straightforward and uncomplicated, then doing this annual exercise is not too onerous providing that you stay on top of your paperwork and invoicing, and have a good idea of what you can claim against your tax, how much and so on.

Why do self-employed people turn to accountants for help?

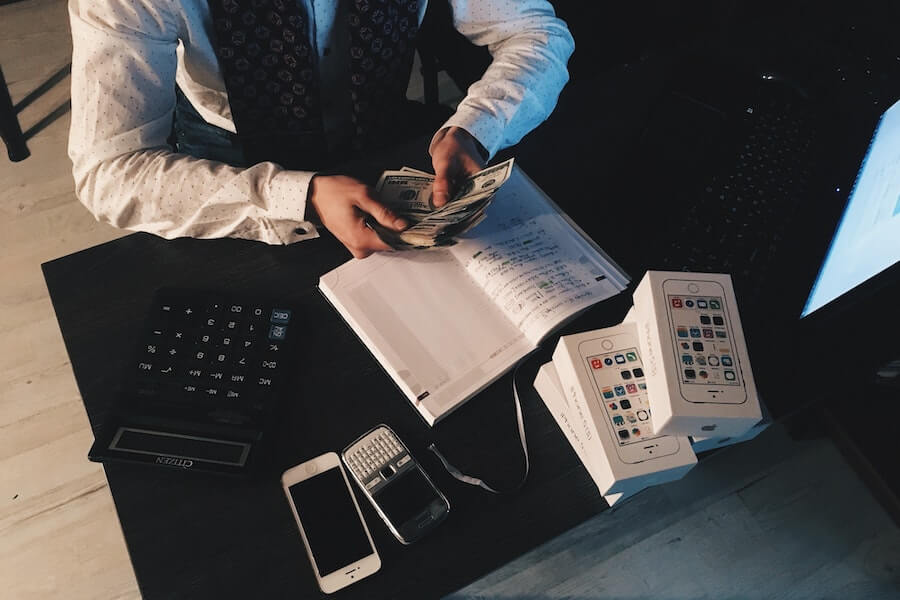

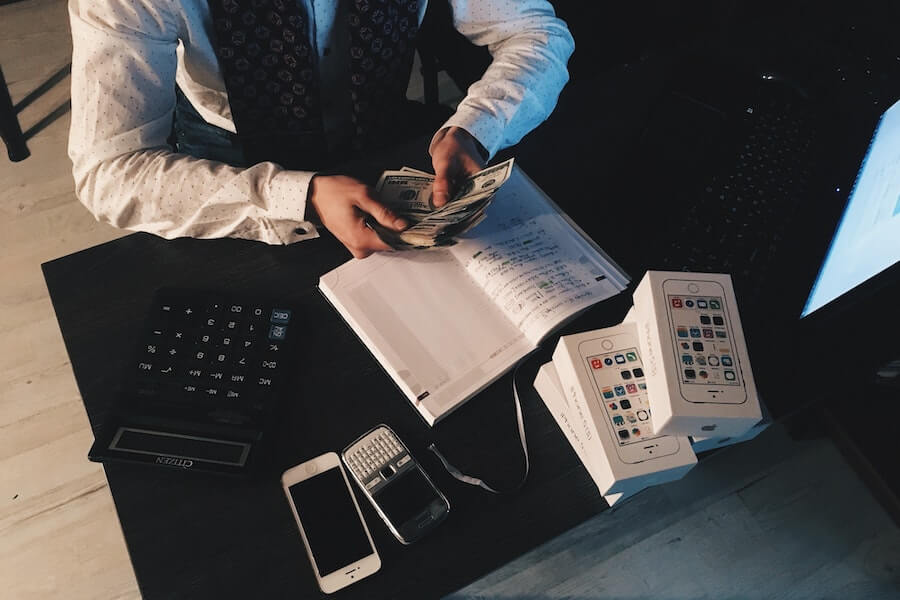

As a business, there will be many things you outsource, such as social media management or website design. It is probably a fairly accurate assumption, however, that the first thing someone who is self-employed does is turn to an accountant for help in managing their finances.

The reasons are many and varied:

-

Financial responsibilities

The way we pay tax in the UK is about to change with the Making Tax Digital initiative. For all businesses, including small businesses and sole traders, the aim is to make paying tax easier and simpler – and to do so more frequently, with tax payments made every quarter.

-

Minimising tax liability

How much tax you pay depends on how much profit your business makes. Clearly, you want to make a profit but you also want to keep hold of as much of the profit you make as possible to reinvest back into your business and to grow it.

Tax rules changes with some benefitting your business and some not. Can you really stay on top of all these changes?

-

Save you time

An accountant can save you time by doing all the work needed to file your tax returns and to meet all the other financial obligations placed on people running their own business. As you grow, you will find a professional relationship with an accountant is one that you rely on more and more.

Being your own accountant

However, there are many self-employed people who find their own answer to ‘do I need an accountant’ and can ‘account’ for their own business. They keep a tidy and organised set of books, set their business up with an online bookkeeping and invoice software package and manage their tax returns on an annual basis.

There is no doubt that you need an understanding of accounting processes and procedures. Plus, you’ll need to develop sound business habits when it comes to managing the finances of your business. A well-run business is one in which the business owner has a real-time understanding of the financial health of their business and also an understanding of its value.

From basic bookkeeping courses to online accounting courses, it is possible to upskill yourself with a range of financial skills you need to run your business. From maintaining a profit to understanding the importance of cash flow, there are many aspects of business finance that don’t have to be complex or time-consuming.

7 vital questions to ask when working with an accountant

If you’ve decided that you do need an accountant, that’s just the first step! The process to find the right accountant for you can be tricky, and you have to know what you’re looking for. After all, your accountant is going to have a lot of input on your financial decisions. So, while you are looking for an accountant, here are 7 vital questions you should be asking to ensure you make the right decision:

1. What is your experience in my industry?

Knowing if they have an understanding of your industry, the pressures on it and how this affects your financial position. So, it’s worth checking how much they know about your industry.

2. What services do you offer as an accountant?

Not all accountants offer the same services and so you need to be confident about what services you need. Some accountants offer a narrow, specialised service which you may need as some point but if you want a general accountancy service, seek one out that offers what you want.

3. How do you work?

Accountants work in different ways and whilst some work in along more traditional lines, other accountants will work using remote accounting packages. Consider how you would like to work with an accountant and what works best for you and your business.

4. How can I contact you?

You may not need to be in contact with your accountant every minute of every day but there are times when you need their help or advice – and you need to know how to get hold of them. Knowing the best way of contacting them is important, from leaving a voice message to sending a quick email, ask how your accountant works and maintains contact with their clients.

5. How will you help my business grow?

For most businesses, growing a business is critical in staying in the game. You are looking for an accounting professional who will get to know your business and understand the sector in which you operate. They will maintain accurate financial records but also have an understanding of the value of the business.

6. Can you help with legal issues?

You may think that legal issues are the preserve of your lawyer but in fact, an accountant can be instrumental in legal issues relating to finance and tax. Some accountants will offer not only specific services in this areas but insurance packages too.

7. How can I help you?

A professional accountant will help you in many different ways but you will want to know what you can do, as a business owner, to make the financial success of your business more assured.

How much can an accountant cost a small business?

Cost is likely at the forefront of many a mind when it comes to hiring an accountant, especially for a small business. Whilst an accountant is useful for any business, no matter its size, reducing the cost of accountancy services is something a small business would look to do. Just how can a small business benefit from the professional services of an accountant but not be landed with a huge bill? Here are 4 ways you can help lower your accounting costs:

1. Set fees

Many accountants will have specific packages for small businesses in which they charge a set fee for the work carried out. Whilst you can opt to pay in a lump sum, you may also find your accountant willing to allow monthly payments either through the year or for a set period of months.

Within this package, they will complete certain financial services such as creating your business’s tax return, calculating tax liability, financial reports and so on. If your business needs something outside of this package, they will quote for the work separately.

To minimise small business accountancy costs, avoid paying by the hour unless the accountant quotes for a set number of hours. An hourly rate service can yield a rather large bill at the end of it.

2. Get to grips with basic bookkeeping

The less your accountant has to do in terms of getting paperwork in order, the more time they can spend on the important stuff – that is, getting a clearer financial picture of your accounts and the business’s financial health.

What this means is for your small business to have a good grip on basic bookkeeping. Some small businesses, however, do hand over the financial responsibility of their company to an accountant but this is expensive. For your small business, keeping a tight hold of the day-to-day financial organisation of your business will reduce the burden on your accountant.

3. Remote accounting

At one time, businesses kept paper copies of every receipt and invoice with accountancy firms often hidden under a mountain of receipts from their clients!

The digital age is upon us and has reached the world of accountancy and tax too. Modern, forward-thinking accountants will suggest that their clients use an online software accounting program that allows every financial aspect of their business to be organised.

Remote accounting is when physical meetings don’t have to take place, with your accountant having access to your online bookkeeping software. This also allows you to be more organised and with this program generating monthly reports etc., you are relying less on the service of an accountant.

4. Stay organised and prompt

The key, however, to lower accountancy costs is efficiency. The quicker you are able to supply information to your accountant, the more organised your financial procedures are, the more up-to-date your financial records, the less time your accountant will need to spend on putting your financial business in order.

And that is the crux of the argument in saving money on accountancy fees – the MORE your small business does and the LESS time your accountant spends on putting your yearend tax affairs in order or creating financial reports, the LESS you will pay in accountancy fees.

Should I hire an accountant?

In the end, the answer to ‘do I need an accountant’ depends on your personal choice. Some businesses rely heavily on their accountant with financial reports generated every month, whereas other self-employed people do complete all their own business finances.

There is no rule that says how much or how little you can or must use an accountant. It is not uncommon for a self-employed trader to be their own bookkeeper but rely on the professional services of an accountant to complete their self-assessment tax return.

With changes in tax rules, it may be that your accountant can save you money too…