Have you ever wondered how your annual salary stacks up against the national average?

Guide updated October 2022

Salary is usually a reflection of our skills, how long you have been in a particular career or workplace, and your location. It is important to know the average wages because:

- It will help you to filter out jobs when searching for the right one

- It may help you to ask for a pay-rise with confidence that you deserve a higher wage

- It can help you to progress your career and find higher-paid jobs in your field

- Knowing what you can be paid will help you to understand your worth

So, what are the average salaries across the UK? We decided to find out.

This article will compare your salary against the rest of the UK and conclude whether you are being paid what you deserve.

Average UK Salary Annually

The 2021 median was £31,400 for full-time workers and £6,255 for those engaged in part-time work.

According to the Office for National Statistics, the full-time UK salary average in 2020 was £31,285. For part-time workers, the average was £13,549. These figures demonstrate a slight decrease from 2020, when the full-time average was £38,600, while the part-time average was £13,803.[i]

However, the ‘average’ numbers are skewed by the top 10% of individuals making larger amounts of money each year (more than £62,589+). It’s better to look at the median salary, which is found at the exact centre of the wages and is a much better midpoint to judge your salary against.

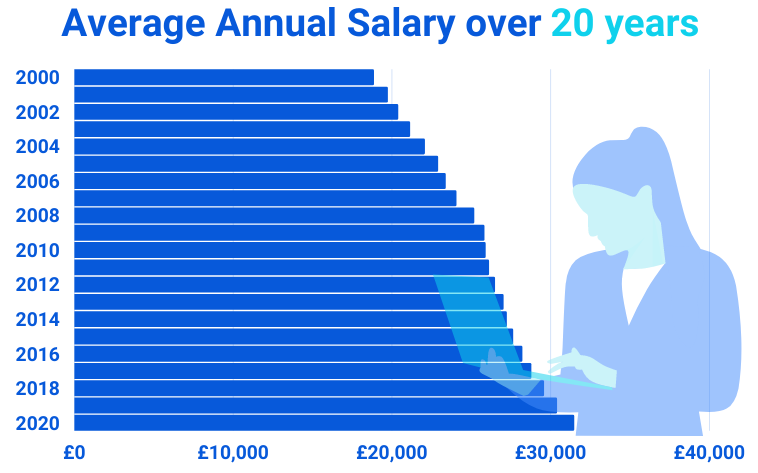

Over the past 20 years, the average yearly UK wage has increased from £18,848 to £31,461, increasing by £12,613.

Average UK Salary by Age

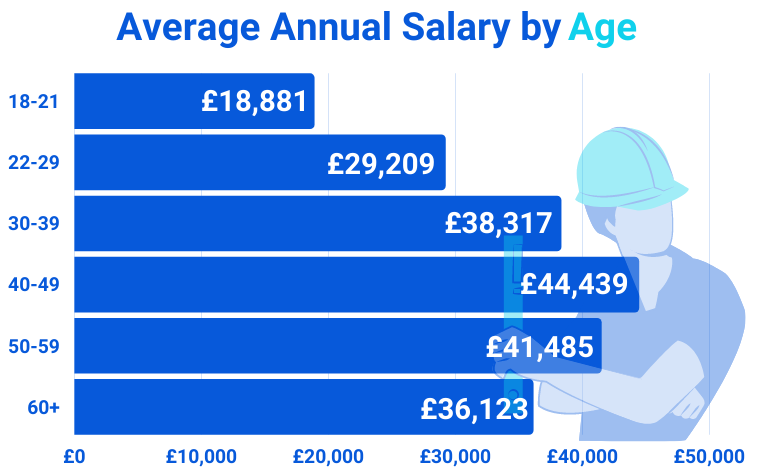

As people age and become more experienced in their careers, their salary will generally increase. Most people start their careers between the ages of 18-21 and will earn around £18,881 a year. Our peak earning period is in our 40s when we earn an annual average of £44k. Over time, the average wage decreases to around £36k when we hit our 60s – the age where many people start working less or retire.

Data from findcourses.co.uk

Average UK Salary by Location

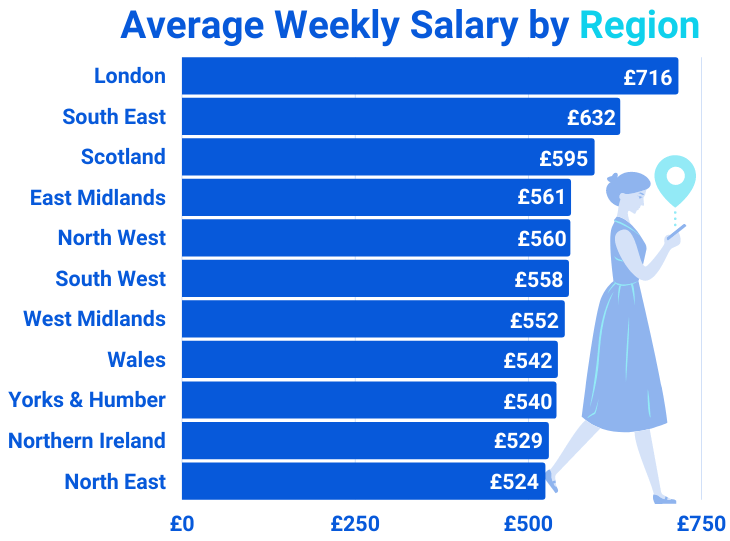

It isn’t just age and gender that affects your income – where you live in the country also has a massive impact on your salary.[vi] The UK has a substantial regional pay gap that shows no sign of slowing down.

The Institute for Fiscal Studies (IFS) recently released a study that shows that incomes in Scotland and the South (excluding London) have grown much faster than in the rest of the country. Average incomes in the Southeast are around 25% higher than those in the West Midlands. It’s no surprise that the West Midlands also has the highest gender gap at 27%.

London is in the top chart for the country’s highest earners, with average weekly earnings in London coming in at £716 a week. The North East and Northern Ireland earn the least, with weekly average wages of £524 and £529, respectively.

Data from House of Commons Library

Average UK Salary by Occupation

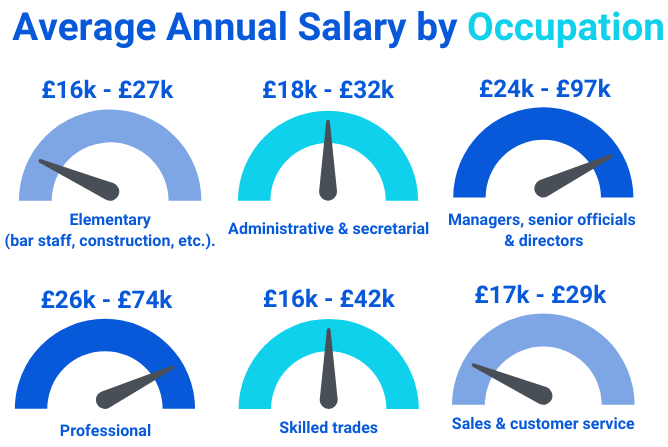

Wages differ massively between different occupations. Generally, managers, directors, and senior officials have the highest wages. Lower income occupations include elementary professions such as bar work, window cleaning and construction.

Data from Office for National Statistics

Data shows that chief executives are the highest earners in the UK, raking in an average of £97k per year. In terms of specific jobs, bar staff ranked the lowest, only earning an average of £16k.

The below chart highlights the annual wages for various job roles.

Data from Office for National Statistics

Boost your salary and break into a new career by taking a home learning course.

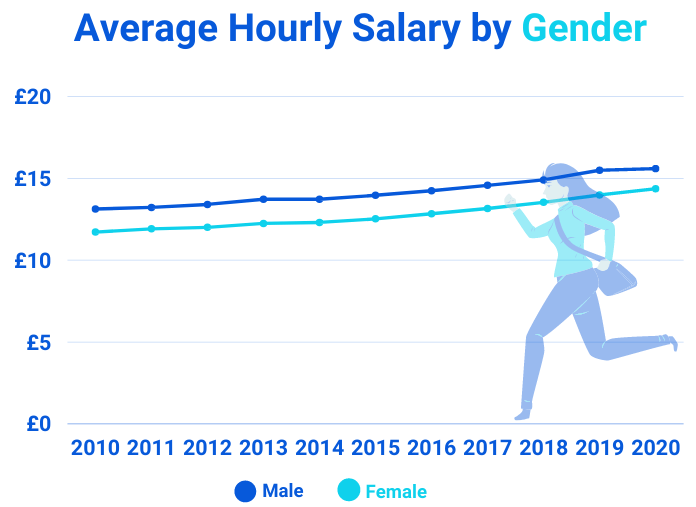

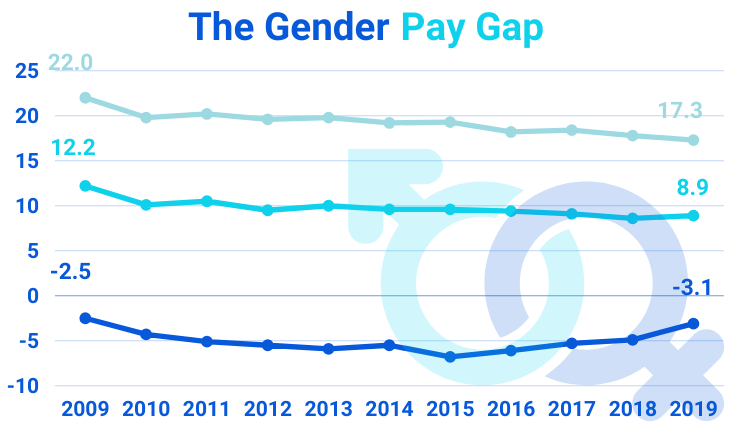

The Gender Pay Gap

The gender pay gap is still prevalent in the UK. In 2019, the UK government reported that the median hourly pay gap between men and women is £4.04.

In 2020, men earned a median of £15.60 per hour, whereas women earned a median of £14.37. This had increased from 2010 when male workers earned a median of £13.13 per hour, and women workers earned £11.72.

Data from Statista

The gender pay gap fell 15.5% across all employees in the year 2020 – meaning the gap is continuing to close.

Data from Office for National Statistics

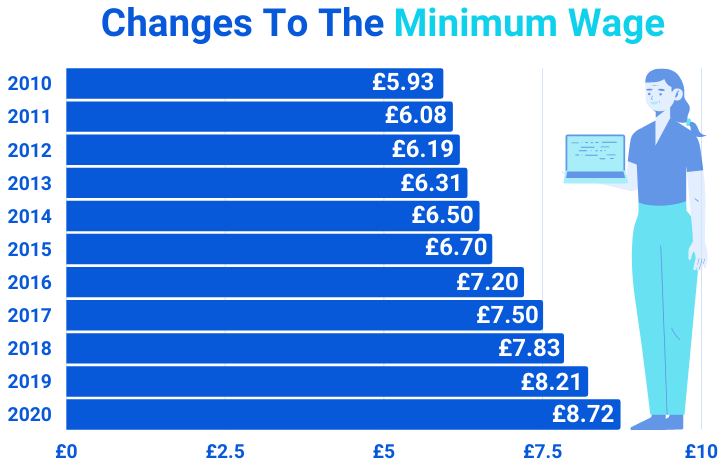

The Minimum Wage

In the UK, the national minimum wage changes yearly to keep up with the cost of living. People are eligible to receive this when they turn 23. The below diagram demonstrates the minimum wage increase, over recent years.

Data from tradingeconomics.com

The following table explains the different age-based minimum wages in the UK.[ii]

| 25 and older | 21 to 22 | 18 to 20 | Under 18 | Apprentice | |

| April 2022 (current rate) | £9.50 | £9.18 | £6.83 | £4.81 | £4.81 |

| April 2021 to March 2022 | £8.91 | £8.36 | £6.56 | £4.62 | £4.30 |

These tend to change each tax year.

Difference between minimum wage and living wage

Chancellor George Osborne introduced the National Living Wage (NLW) in the 2015 Summer Budget, and it came into law on 1 Apr. 2016.[iii] Despite its name, the NLW doesn’t reflect the cost of living.

The NLW means that any person over the age of 25 (who isn’t in the first year of an apprenticeship) must be paid at least £8.72 per hour. It is slightly different from the National Minimum Wage, which applies to workers under 25 (detailed above).

The minimum wages should be going up in April 2021, with the NLW threshold set to change to cover workers over the ages of 23 instead of workers over 25.

| Rate from April 2020 | Rate from April 2021 | Increase | |

| National Living Wage | £8.91 | £9.50 | 6.62% |

| 21-22 Year Old Rate | £8.36 | £9.18 | 9.18% |

| 18-20 Year Old Rate | £6.56 | £6.83 | 4.11% |

| 16-17 Year Old Rate | £4.62 | £4.81 | 4.11% |

| Apprentice Rate | £4.30 | £4.81 | 11.8% |

| Accommodation Offset | £8.36 | £8.70 | 4.06% |

Table from GOV.UK site – see full report here

The National Living Wage is different than the wage calculated by the Living Wage Foundation. They recommend a UK-wide living wage of £9.50 per hour, and £10.85 for London workers.

Learn more about careers, education, and get free advice from experts on the NCC Home Learning Blog

Sources

[i] https://www.gq-magazine.co.uk/article/average-uk-salary

[ii] https://www.gov.uk/national-minimum-wage-rates

[iii] https://www.crunch.co.uk/knowledge/employment/living-wage-minimum-wage-whats-difference/

[iv] https://blog.ons.gov.uk/2019/04/16/decoding-the-gender-pay-gap-how-a-bletchley-park-codebreaker-helped-explain-a-strange-paradox/

[v] https://www.personneltoday.com/hr/pay-in-it-uk-how-does-age-affect-pay-in-tech-sector-information-technology/#:~:text=For%20younger%20employees%20average%20annual,to%20be%20promoted%20each%20year.

[vi] https://www.independent.co.uk/money/spend-save/regional-pay-gap-gender-equality-south-east-london-north-midlands-wales-women-gender-a8043911.html

Chart data sources

https://www.statista.com/topics/3850/wages-and-salaries-in-the-uk/

https://www.findcourses.co.uk/inspiration/average-salaries-uk/average-uk-salary-2020-2021-19759

https://commonslibrary.parliament.uk/research-briefings/cbp-8456/