Not sure if AAT is the right path for you? You’re not alone—many people ask the same thing before starting a finance career.

In the world of accounting, AAT is a well known educational body that many professionals within the industry need to undertake in order to pursue a career in it. But what is an AAT, and is it worth it? In this article, we’ll look at what an AAT qualification actually is, how it works, and why it’s such a popular choice for people looking to get into accounting. From salary expectations to online learning options, we’ll cover the main AAT benefits and help you decide: is AAT worth it for you?

Key Points:

- AAT is a well-known accounting qualification with no entry requirements

- It’s made up of three main levels: Foundation, Advanced, and Professional

- You can complete the qualification online and at your own pace

- AAT can lead to well-paid roles in many different industries

- It’s often a cheaper and quicker alternative to university

- What Is AAT?

- Are There Different Levels To AAT?

- How Long Does An AAT Qualification Take?

- Is AAT Worth It?

- 1. What Is An AAT Qualification Good For?

- 2. Can You Earn a Good Salary with AAT?

- 3. Want to Work for Yourself?

- 4. International Recognition

- 5. Practical Skills Employers Actually Want

- 6. Boost Your Career With Other Professional Bodies

- 7. Membership Has Its Perks

- 8. AAT vs. University: What’s the Better Option?

- 9. A More Practical Route

- 10. No Experience? No Problem

- 11. Learning That Fits Around You

- Should You Choose AAT Over a Degree?

- Why NCC Home Learning is a Great Place to Start

- FAQs

- Sources

What Is AAT?

AAT stands for the Association of Accounting Technicians—a well-known organisation that supports people working in accounting and finance, and is one of the most recognised names in the UK for accounting qualifications.

Are There Different Levels To AAT?

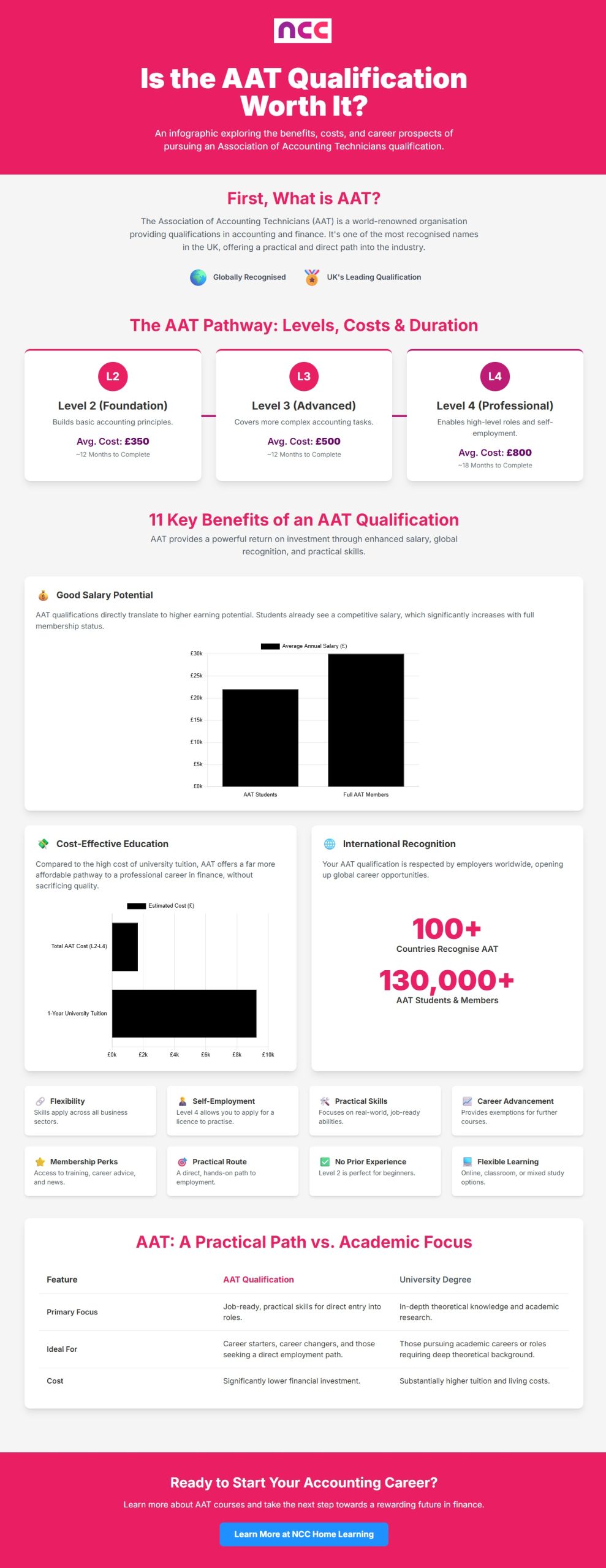

Yes, and that’s one of the AAT benefits—it’s built to suit all experience levels. The qualification is split into four levels:

- Access (an optional starting point)

- Level 2 (Foundation): Great for beginners. It teaches you the basics, like bookkeeping and finance principles. Average cost: around £350

- Level 3 (Advanced): Ideal for those with some background or who’ve completed Level 2. Average cost: around £700

- Level 4 (Professional): Prepares you for senior roles and gives you the skills to handle more complex tasks. Average cost: around £800

You can start with no previous qualifications, which is great if you’re thinking of changing careers or starting afresh.

How Long Does An AAT Qualification Take?

Most people finish Level 2 and 3 in around 12 months each, though it’s possible to complete them faster. Level 4 typically takes about 18 months. Since the courses are flexible and can be studied online, it’s easier to work through them at your own pace.

Is AAT Worth It?

If you’re looking for a job in finance or want to retrain in a new field, AAT is a strong choice. It gives you the hands-on skills employers actually look for. Plus, it’s respected by companies around the world. Now, let’s look at the range of benefits that you can gain from an AAT qualification:

1. What Is An AAT Qualification Good For?

One of the biggest AAT benefits is flexibility. You’re not tied to just one type of job or career path. While many people use it to move into accountancy roles, the skills you learn are relevant to almost every business sector.

You could work in:

- Accountancy firms

- Retail and e-commerce

- Sport and entertainment

- Public services and charities

- Media and tech companies

Finance is part of every business. If you’re passionate about a particular industry, there’s a good chance your AAT qualification could help you land a finance-related role within it.

2. Can You Earn a Good Salary with AAT?

Yes, and salaries tend to grow as you move through the levels of study. At the time of writing this article, AAT students typically earn around £22,000 per year, while full AAT members often earn closer to £30,000 or more.

As your skills develop, your value to employers grows. This makes AAT an affordable route into finance with real earning potential—especially compared to longer, more expensive qualifications.

3. Want to Work for Yourself?

Another benefit of gaining an AAT qualification is that it opens the door to self-employment. Once you’ve completed Level 4 and become a full AAT member, you can apply for a licence to practice. This means you can offer your own accounting and bookkeeping services legally and professionally.

Going self-employed gives you more freedom. You can choose your own clients, set your own hours, and control how much you want to work. Learn if you need an accountant if you’re self-employed.

Plus, AAT offers support along the way—so you’re not doing it alone.

4. International Recognition

AAT qualifications are well known around the world. In 2025 alone, there are over 130,000 students and members in more than 100 countries, making it clear that this qualification isn’t just respected in the UK.

If you want to work abroad or for a company with international links, your AAT certificate won’t hold you back.

This makes it a smart option for anyone thinking long term about travel or relocation, or just wanting to keep their options open.

Are your secondary languages up to scratch? Try our online language learning courses and prepare yourself for studying or working abroad.

5. Practical Skills Employers Actually Want

Some courses focus heavily on theory, leaving you unprepared for the real world. That’s not the case with AAT.

AAT qualifications are built with employers in mind. They’re regularly updated to match what’s happening in the industry. You’ll learn the things you’ll actually use in your day-to-day job—like managing budgets, dealing with tax, using software, and preparing reports.

If you’re asking yourself, what is an AAT qualification good for? It’s this: giving you the hands-on knowledge that companies are looking for.

AAT qualifications are developed in collaboration with employers to make sure they teach the most useful, up-to-date skills.

That’s why many job ads specifically ask for candidates with AAT.

6. Boost Your Career With Other Professional Bodies

If you’re thinking of going even further in your career, you might already be looking at Chartered Accountant status. AAT can help with that too.

AAT qualifications can give you exemptions from parts of other professional courses, such as:

- ACCA (Association of Chartered Certified Accountants)

- CIMA (Chartered Institute of Management Accountants)

- CIPFA (Chartered Institute of Public Finance & Accountancy)

- ICAEW (Institute of Chartered Accountants in England and Wales)

This means you won’t need to sit every exam from scratch, helping you save time and money on your way to becoming fully chartered.

7. Membership Has Its Perks

Once you complete Level 4, you can apply for full AAT membership. This includes:

- Use of AAT letters after your name

- Free training, events, and webinars

- Career advice and technical support

- Discounts and industry news

It’s more than just a qualification—it’s a community.

8. AAT vs. University: What’s the Better Option?

When thinking about your future in finance, one big question often comes up—is AAT worth it compared to a university degree? For many people, the answer comes down to cost, flexibility, and how fast you can get qualified.

University tuition fees in the UK, as of 2025, currently sit at around £9,250 per year, not including extra living costs or maintenance loans. Multiply that over three or four years, and you could easily graduate with over £30,000 of debt.

Now compare that to an AAT qualification. Depending on the level, you’ll likely spend between £800 and £1,500 in total. That’s a fraction of the cost—and for many, a much smarter way to get into the industry without the long-term financial pressure. Learn is a masters worth it?

9. A More Practical Route

It’s also important to think about what you’re actually learning. University degrees often focus heavily on theory. While that’s valuable, it doesn’t always prepare you for the workplace.

So, what is an AAT qualification giving you instead? Real, job-ready skills.

AAT courses are built around what finance professionals do every day—working with budgets, handling tax returns, managing accounts, and using software like Sage or Xero. You’re gaining experience that employers actively look for.

This is one of the biggest AAT benefits—you can step into a job feeling prepared, not overwhelmed.

10. No Experience? No Problem

Another advantage of AAT is that you don’t need a background in finance to get started. If you’ve never worked in accounting or bookkeeping before, you can start with a Level 2 qualification.

It’s ideal for anyone switching careers, returning to work after time away, or simply looking for a new challenge. AAT makes it possible to build a career from the ground up—even if you’re starting from scratch.

Check out the best high paying jobs with no experience or degree needed

11. Learning That Fits Around You

AAT courses are designed to be flexible. You can choose how and when to study:

- Online, at your own pace

- In a classroom, with regular sessions

- A mix of both

This means you don’t need to put your life on hold. You can work, care for family, or manage other responsibilities while still moving forward with your training.

Whether you’re a full-time parent, working part-time, or juggling shifts, AAT makes it easier to fit study into your life—not the other way around. Discover more about what is flexible learning, and whether it is possible to work and study at the same time.

Should You Choose AAT Over a Degree?

That depends on what you’re looking for. If you want in-depth academic knowledge and can commit to three years or more of full-time study, a degree may suit you. But if you’re keen to gain real-world finance skills, start earning sooner, and avoid student debt, AAT is a strong alternative.

It’s also faster. Many students complete AAT Level 4 in around 18 months. That means you could be job-ready while your university friends are still in their second year of lectures.

And unlike some degrees, AAT qualifications are regulated by UK bodies like Ofqual, CCEA, SQA, and Qualifications Wales. This gives them credibility and helps explain why employers trust them.

You could qualify as a finance professional with AAT for less than 10% of the cost of a university degree—and start working up to two years sooner.

Why NCC Home Learning is a Great Place to Start

If you’re ready to explore the benefits of AAT, NCC Home Learning can help. We offer a range of fully online accounting courses, designed for flexible study with full tutor support. You don’t need previous experience to begin, and you can work through each level at your own pace.

Studying accounting online is perfect for people who want to start a new career in finance, improve their job prospects, or gain the confidence to go freelance. With NCC, you’ll get all the support you need to succeed—no classrooms, no pressure, and no delays, and before you know it, you could find yourself in one of the highest paying accounting jobs.

Find out the full process on how to become an accountant.

FAQs

Do I Need GCSEs to do an AAT Course?

While it’s recommended you have a good standard of English and Maths to study an AAT training course, you don’t need GCSEs to do an AAT course.

You can start any of the courses so long as you have sufficient skills and experience, but this doesn’t necessitate certain GCSE requirements. Naturally, if you have no prior financial experience or knowledge specifically, you will start with a lower level course to learn the basics. As you develop your knowledge, you would then move up the levels of courses on offer to reach your learning and career goals.

Will an AAT qualification help me get a job?

Many employers look for AAT-qualified candidates for roles such as accounts assistant, bookkeeper, finance officer, or payroll administrator, so it can significantly improve your job prospects.

Use our infographic for free using the download link subject to mentioning NCC homelearning as the source or copy and paste the embed code below:-

<!-- wp:html -->

<!-- Start AAT Qualification Infographic Embed Code -->

<div style="text-align: center; margin: 20px 0;">

<img

src="https://www.ncchomelearning.co.uk/blog/wp-content/uploads/2025/06/ncc-aat-infographic-scaled.jpg"

alt="Is the AAT Qualification Worth It? Infographic by NCC Home Learning"

style="max-width: 100%; height: auto; display: block; margin: 0 auto; border-radius: 8px; box-shadow: 0 4px 8px rgba(0,0,0,0.1);"

/>

<p style="text-align: center; font-family: sans-serif; font-size: 14px; color: #555; margin-top: 10px;">

Source: <a href="https://www.ncchomelearning.co.uk/blog/is-aat-worth-it/" target="_blank" rel="noopener noreferrer" style="color: #E91E63; text-decoration: none; font-weight: bold;">AAT Qualification Infographic by NCC Home Learning</a>

</p>

</div>

<!-- End AAT Qualification Infographic Embed Code -->

<!-- /wp:html -->Sources

ACCA. (2013) Association of Chartered Certified Accountants. [online] Available at: https://www.accaglobal.com/gb/en.html [accessed 09/05/2025]

AICPA & CIMA. (2023) Association of International Certified Professional Accountants & Chartered Institute of Management Accountants. [online] Available at: https://www.aicpa-cima.com/home [accessed 09/05/2025]

CIPFA. (1999) Chartered Institute of Public Finance & Accountancy. [online] Available at: https://www.cipfa.org/ [accessed 09/05/2025]

ICAEW (2000) Institute of Chartered Accountants in England and Wales. [online] Available at: https://www.icaew.com/ [accessed 09/05/2025]

Indeed Editorial Team. (2024) Highest paying accounting jobs (with duties and salaries). Indeed. [online] Available at: https://uk.indeed.com/career-advice/finding-a-job/highest-paying-accounting-jobs [accessed 09/05/2025]